The cryptocurrency payment landscape is evolving rapidly, with digital payment solutions becoming increasingly essential for modern financial transactions.

Did you know?

The global crypto payment gateways market was valued at $1.2 billion in 2023 and is projected to grow at a CAGR of over 15% through 2032.

This surge is driven by the increasing adoption of digital currencies, with over 560 million cryptocurrency users worldwide as of 2026. In this context, understanding the nuances of platforms like RedotPay vs Nebeus becomes crucial for businesses and individuals looking to optimize their transactions.

Both platforms offer unique features tailored to different user needs, from instant crypto-to-fiat conversions to multi-currency account management. This blog will delve into the strengths and weaknesses of each platform, helping you make an informed choice in the dynamic world of cryptocurrency payments.

Company Overview

The foundation of any financial service provider lies in its institutional strength and regulatory compliance. Let's examine how these two platforms measure up:

RedotPay: Hong Kong's Digital Payment Pioneer

RedotPay emerges from Hong Kong's vibrant fintech ecosystem, focusing on bridging the gap between traditional finance and cryptocurrency. As a Hong Kong-based platform, it operates under strict regulatory oversight, ensuring robust security measures for users' assets.

RedotPay is primarily designed for businesses and freelancers looking to integrate cryptocurrency payments seamlessly into their operations. With its focus on global payment solutions, it offers a user-friendly interface that simplifies transactions.

Financial innovation meets regulatory compliance in the heart of Asia's financial hub.

Nebeus: European Crypto Veteran

Founded in 2014, Nebeus has established itself as a prominent player in the European cryptocurrency space. The platform operates under the watchful eye of the Bank of Spain (registration number D664) and partners with Money-4 Limited, demonstrating its commitment to regulatory compliance and financial innovation.

Nebeus caters to a broader audience, including digital nomads and crypto enthusiasts. It provides multi-currency accounts and a cryptocurrency debit card, allowing users to spend their digital assets easily.

Card Features Comparison: RedotPay vs Nebeus

When it comes to payment capabilities, both platforms offer distinct advantages:

| Feature | RedotPay | Nebeus |

|---|---|---|

| Merchant Coverage | Global Network | 90+ million merchants |

| ATM Withdrawal Limit | Variable | 2,000 EUR/USD/GBP monthly |

| Card Issuance Fee | Varies | Free |

| Virtual Card Option | Yes | Yes, instant activation |

| Card Options | Physical & Virtual | Physical & Virtual |

| Security Features | KYC procedures; cold storage | Two-factor authentication; insured cold wallets |

| Wallet Management | Unique blockchain address for each client | Multi-currency accounts with digital assets |

1. Payment Network & Acceptance

RedotPay operates through the Visa payment network, enabling transactions at over 44 million merchants across 160+ countries. The platform supports both virtual and physical cards, with seamless integration for Apple Pay and Google Pay services.

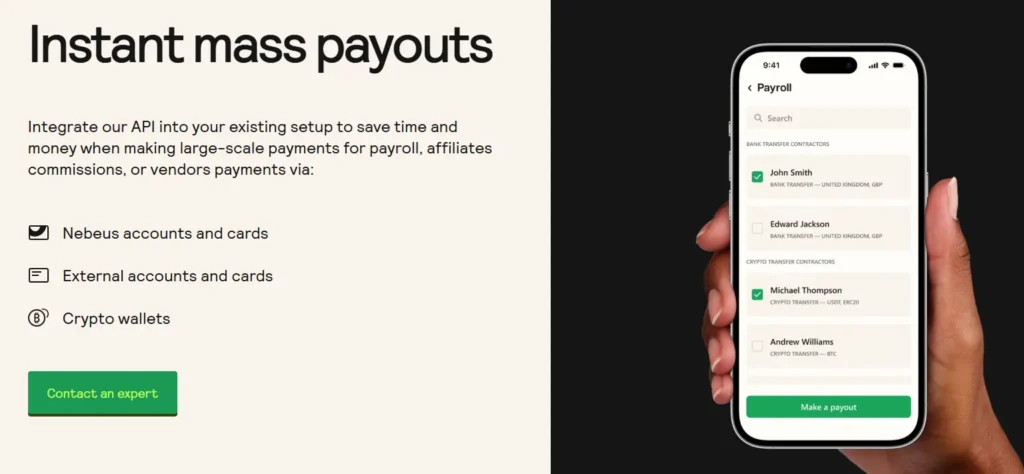

Nebeus provides access to over 90+ million merchants worldwide through their card services. The platform facilitates payments with both crypto and fiat currencies, offering automatic currency exchange features for local payments.

2. Pricing & Fees

Understanding the cost structure is crucial for making an informed decision. Here's a detailed breakdown of what you can expect:

Card Costs Decoded

RedotPay implements a tiered pricing structure that rewards active users:

| Transaction Type | RedotPay | Nebeus |

|---|---|---|

| Card Issuance | Virtual Card- $10 Physical Card- $100 | Free |

| Monthly Fee | No fee | No fee |

| ATM Withdrawal | 2% | 1.85% (1.5 GBP/EUR/USD) |

Smart pricing isn't just about being cheap – it's about delivering value at every transaction point.

Exchange Rate Excellence

Both RedotPay and Nebeus strive to offer competitive exchange rates, a crucial factor for users frequently converting between cryptocurrencies and fiat currencies. However, it's essential to consider the potential impact of conversion fees, especially when dealing with multiple currencies.

3. Special Features

The devil is in the details, and both platforms offer unique features that set them apart.

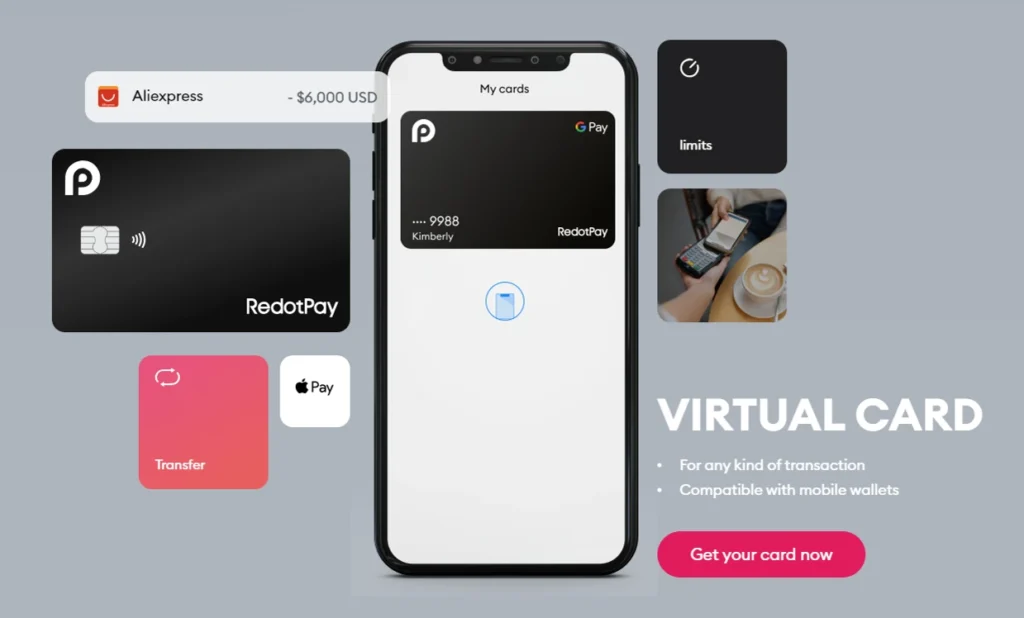

Virtual Card Innovation

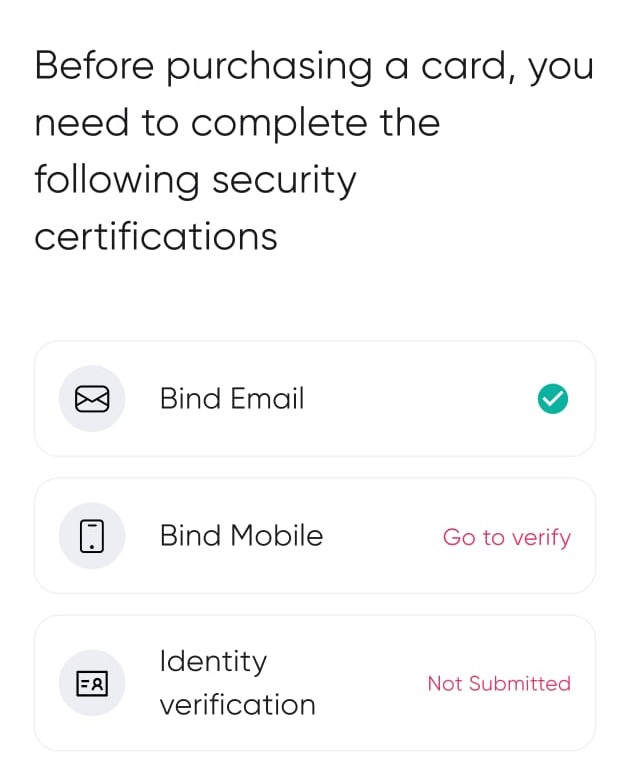

RedotPay's virtual card system provides:

- Instant activation within 3 minutes

- Dynamic CVV technology

- Integration with major mobile wallets

Meanwhile, Nebeus offers:

- Multiple virtual card creation

- Customizable spending limits

- Real-time transaction notifications

Physical Cards: Design Meets Functionality

The physical cards from both providers showcase their commitment to quality:

| Feature | RedotPay | Nebeus |

|---|---|---|

| Material | Plastic | Metal/Plastic |

| Contactless | Yes | Yes |

| Delivery Time | 5-15 days | 3-7 days |

4. Platform Integration

RedotPay offers seamless integration with popular platforms like Apple Pay and Google Pay, enhancing user convenience. In contrast, Nebeus supports bank integrations for crypto transactions, allowing easy deposits and withdrawals in both crypto and fiat currencies.

Both platforms provide APIs for developers, but RedotPay focuses on crypto deposits via Binance Pay, while Nebeus excels in facilitating crypto-to-fiat conversions.

5. Geographical Availability

The global reach of these platforms varies significantly:

RedotPay's Market Presence

Currently available in over 160 countries, with strong presence in:

- Asia Pacific Region

- European Economic Area

- Select African nations

Nebeus Territory

Nebeus, registered with the Bank of Spain (registration number D664), operates as part of Money-4 Limited, offering services primarily to European customers.

Focused primarily on:

- 23 EU countries

- 3 EEA countries

- Global crypto transactions (except restricted 29 countries, including the US, UK, and Russia)

6. Security & Compliance

In the cryptocurrency space, security isn't just a feature – it's a foundation.

RedotPay employs advanced encryption technologies and partners with licensed custodians to safeguard user assets. The platform adheres to strict Know Your Customer (KYC) regulations, requiring users to complete identity verification before accessing certain services.

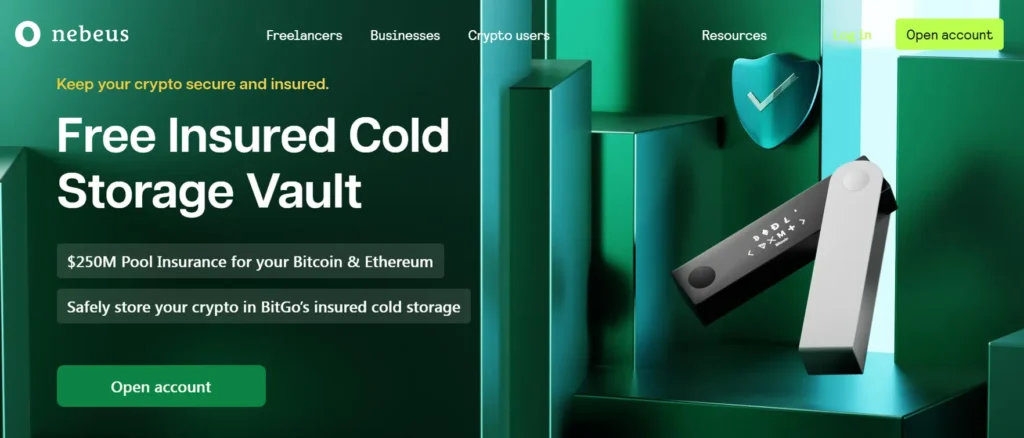

Nebeus (Rintral Trading SL) is officially registered with the Bank of Spain, underscoring its commitment to regulatory compliance. The platform implements stringent security protocols, including two-factor authentication (2FA) and cold storage solutions for crypto assets. Nebeus also provides comprehensive resources on security best practices to educate users on protecting their accounts.

FAQs: Your Essential Guide to Crypto Payment Solutions

Can I hold multiple currencies in both platforms?

Yes, both platforms support multi-currency wallets with instant exchange capabilities.

What are the maximum transaction limits?

RedotPay offers customizable limits up to $50,000/month, while Nebeus caps at €20,000/month for standard users.

Are these cards accepted worldwide?

Both cards are accepted wherever Visa is accepted, covering over 200 countries and territories.

Can I earn interest on my crypto holdings?

Nebeus offers yield-generating savings accounts for certain cryptocurrencies, while RedotPay focuses more on spending and transfer services.

Are there any tax implications for using these services?

Cryptocurrency transactions may have tax implications depending on your jurisdiction. It's advisable to consult with a tax professional for personalized advice.

Can I use RedotPay or Nebeus cards for everyday purchases?

Yes, both platforms offer cards that can be used for daily transactions wherever Visa is accepted.

Are my crypto assets safe with these platforms?

Both RedotPay and Nebeus employ industry-standard security measures, including cold storage and insurance coverage, to protect user assets.

Conclusion

The choice between RedotPay vs Nebeus ultimately depends on your specific needs:

Choose RedotPay if you:

- Require extensive Asia-Pacific coverage

- Value competitive exchange rates

- Need robust mobile wallet integration

Choose Nebeus if you:

- Prioritize European regulatory compliance

- Seek lower initial card costs

- Want integrated lending features

Both platforms provide strong security measures and customer support, ensuring users can transact confidently.